ANAF eFactura SAP plugin

Romanian e-invoicing made easy!

Save money with the perfect solution for your SAP system

ANAF eFactura is available as of 1. January 2024!

What is ANAF eFactura?

All invoices issued in Romania must be automatically reported to the Romanian tax authorities (ANAF) online within 5 working days.

What is the deadline for reporting this way?

On the 31. March the no-sanction-period will end.

After that RON 1.000 to RON 10.000 fine will be applicable.

After 30. June 2024 only those invoices will be valid that go through the ANAF eFactura system.

International solution for related reporting obligations

Several countries around the world are moving to the digital era, introducing electronic business reporting. Our solution offers a common cockpit for your country-specific needs:

- e.g.: If your company is registered in Romania with a Romanian VAT ID, but also has a Hungarian VAT ID for some project work, our Cockpit will separate the invoices issued under these separate VAT IDs, and report them with the correct Romanian and Hungarian protocol accordingly.

Out of the box solution

Multilingual support desk

Long term support & upgrades

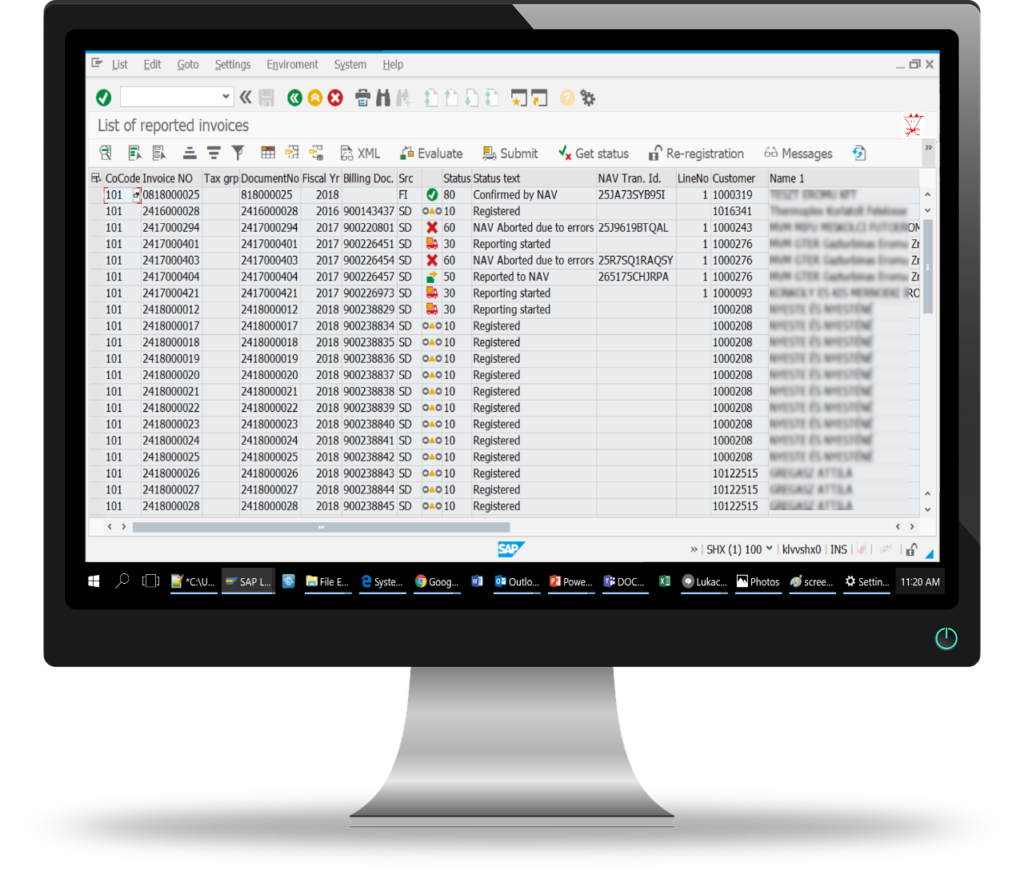

- Automatic invoice checking & submission to ANAF

- Management cockpit for invoice status – at one glance

- Automatic notifications in case of errors or malfunction

- Pure ABAP, direct communication with NAV, no middleware necessary

- Optional SCPI/Cloud connection possibility

- Straightforward pricing – no hidden costs

- Long term support & updates

- ANAF version changes are covered by the support fee

SystemFox Webinar

Enough of the usual sales slides? We are offering you a free online session, with real experts presenting and explaining you our solution. Both business and technical questions are welcome!